In the recent weeks, some cycles that appeared within the price charts of a selected number of stocks for which their predictions were prepared and presented to a group of options traders, for tracking this technology, were missing from the prediction graphs.

Although this was surprising, after intensive research and development a new updated model called U was developed.

Bottom line

Model U adds more information for short lived cycles and thus may sometimes be more accurate for short periods of 1-2 months than the existing model G.

Verification of the new “U” model with the random set of stocks

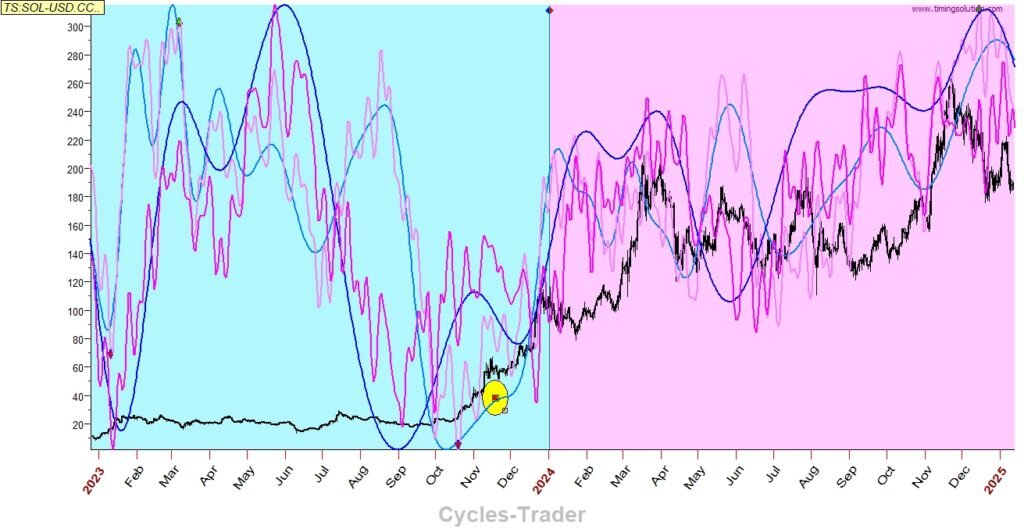

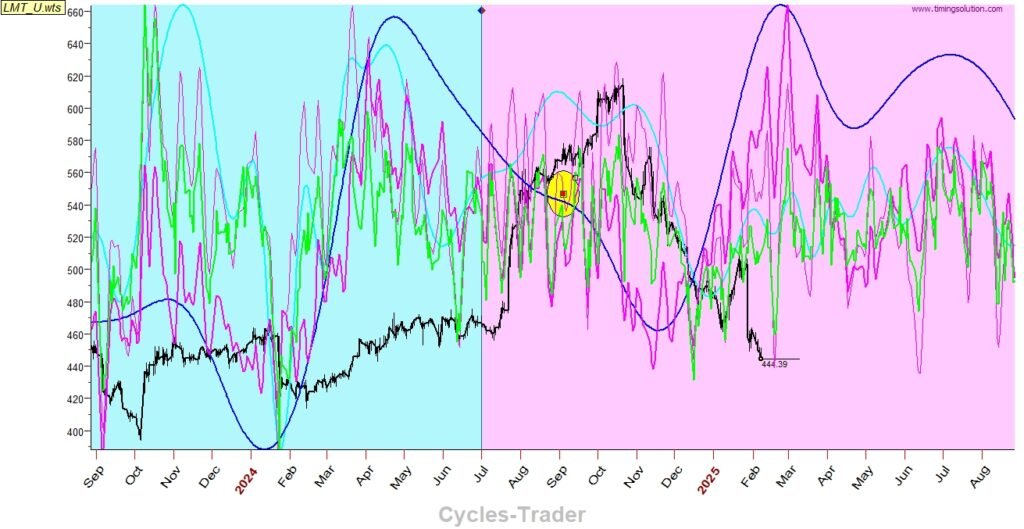

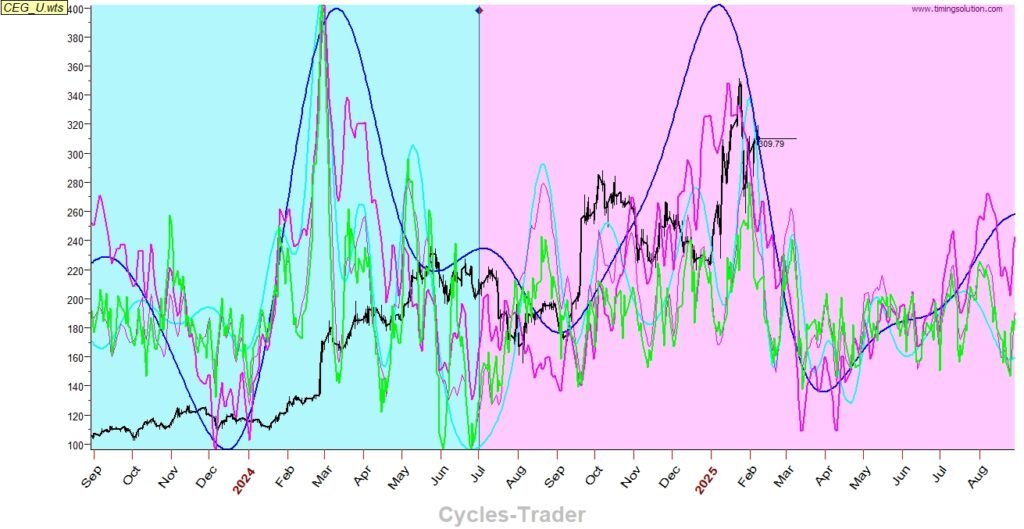

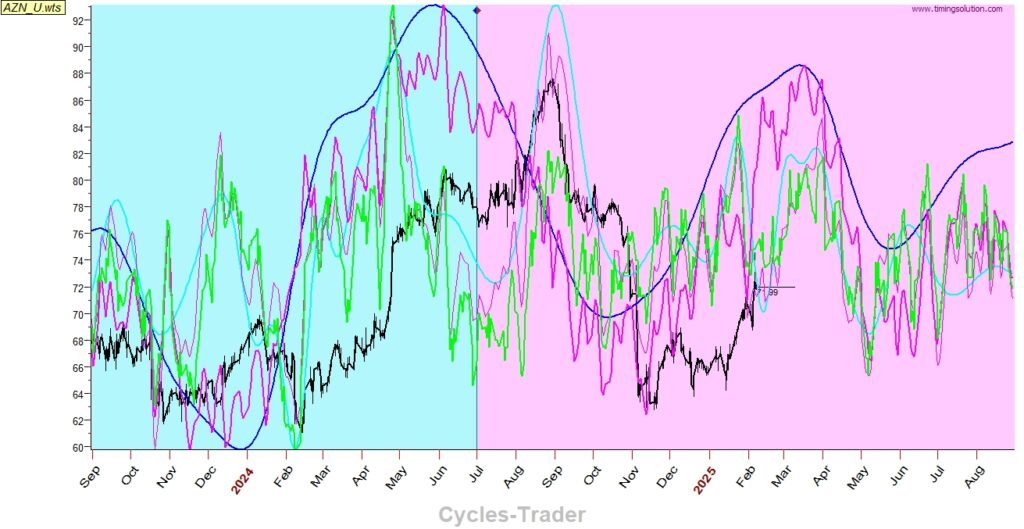

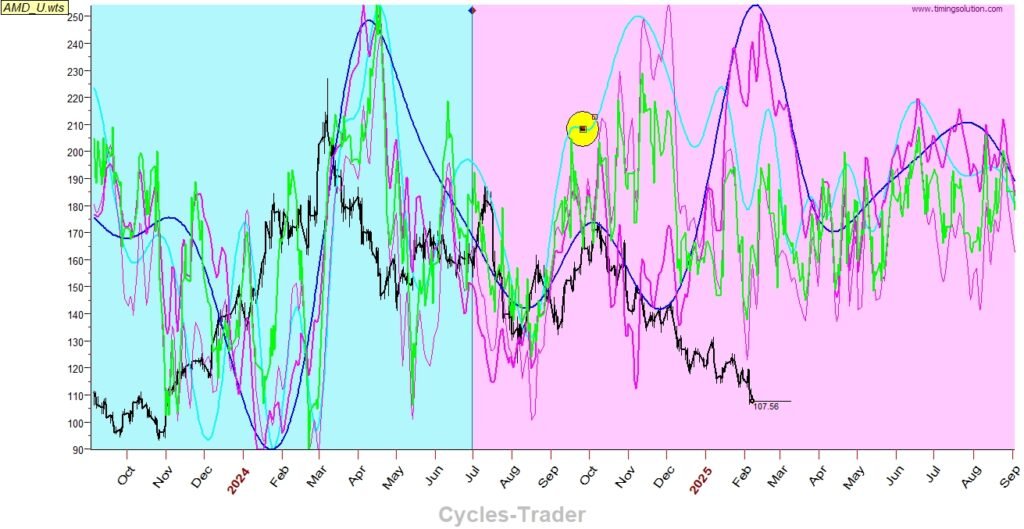

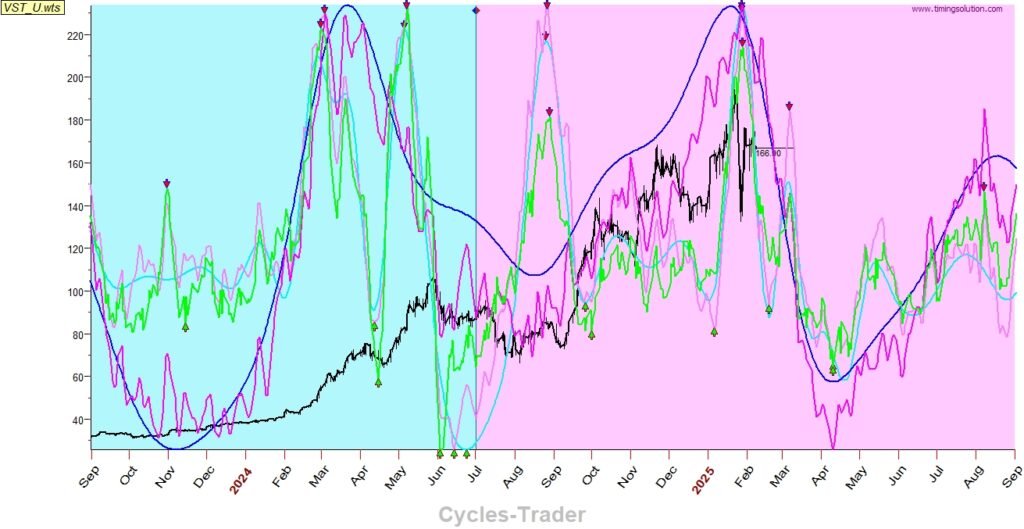

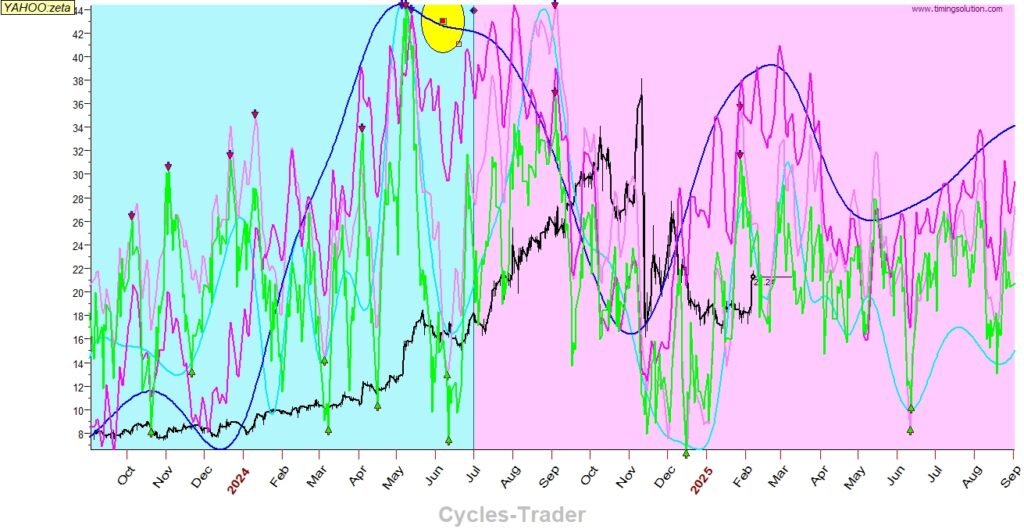

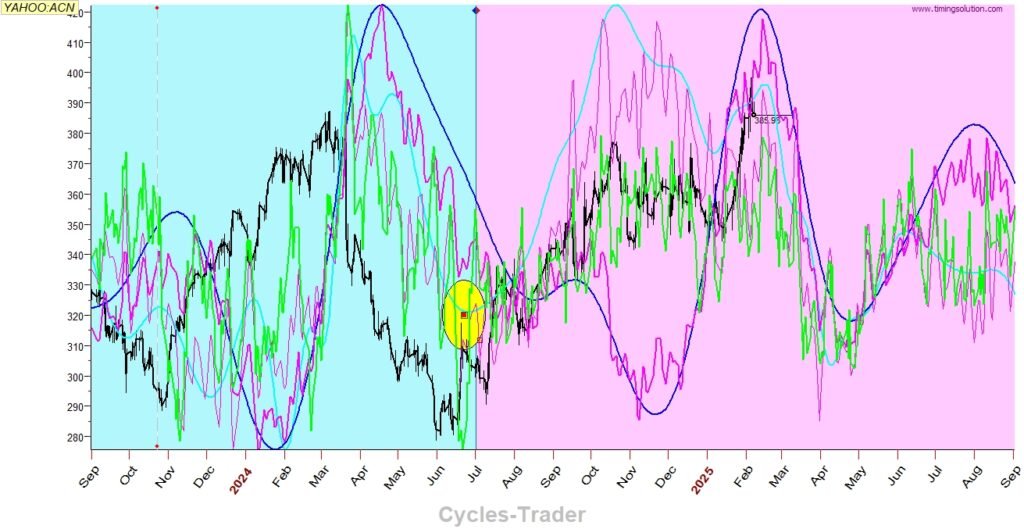

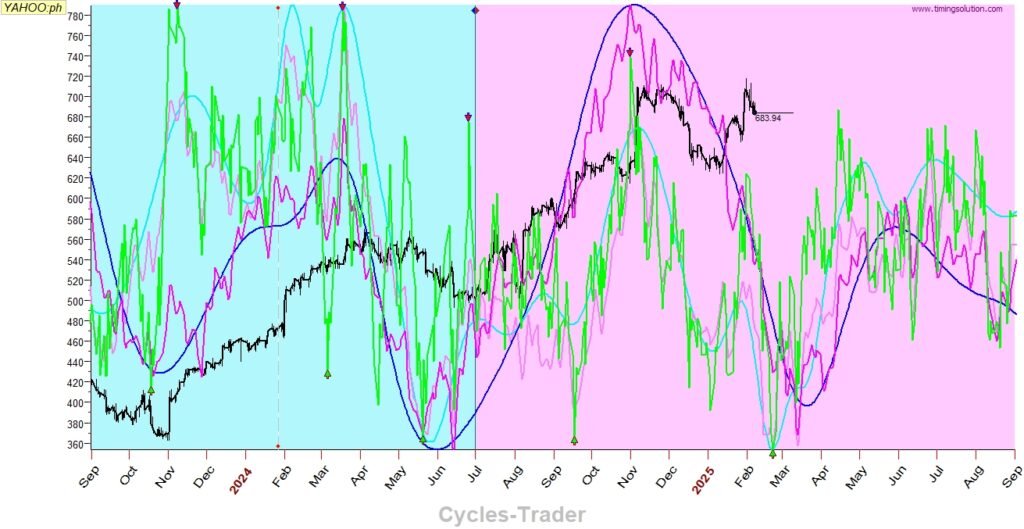

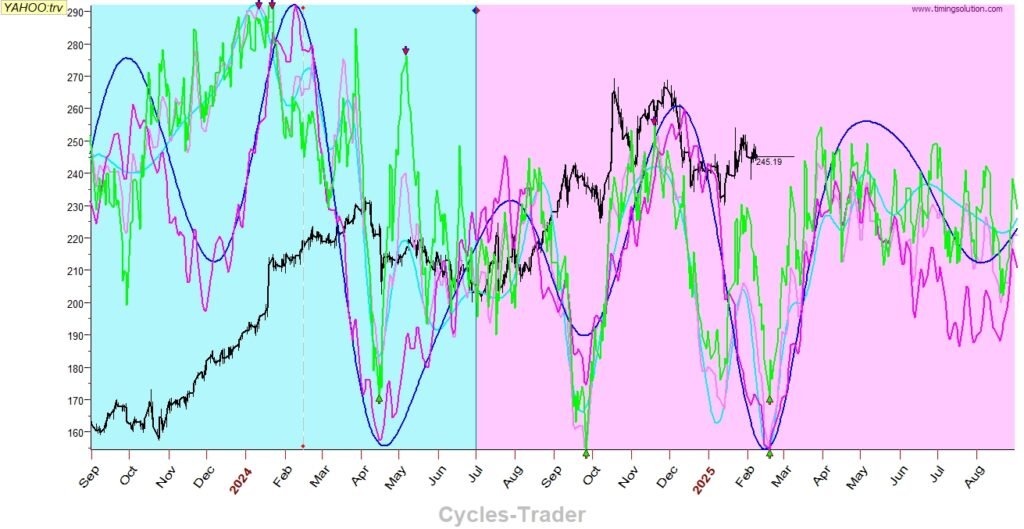

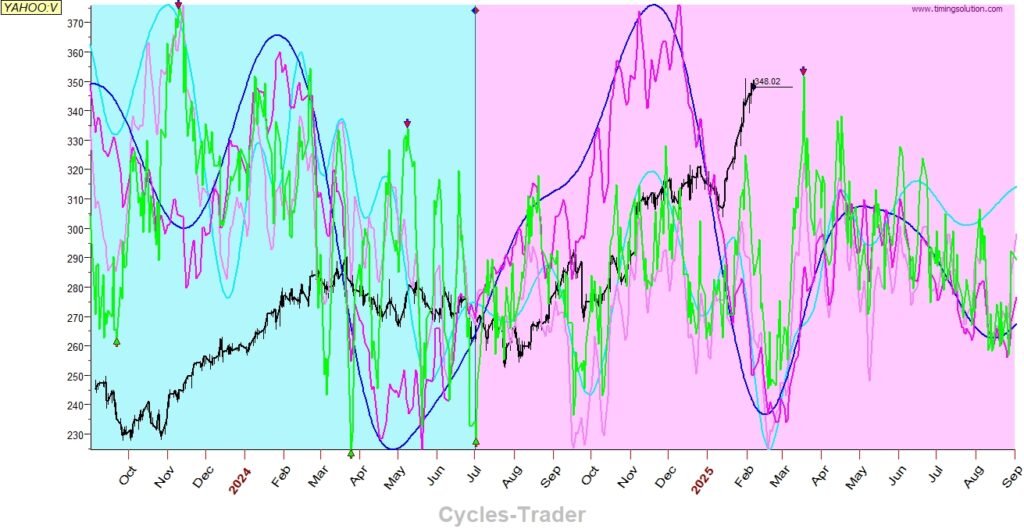

Here is a set of prediction charts for this set of stocks, from July 2024 till today Feb 2025 (7 months).

The target was to compare the new model U with the existing model and see where it performs better.

As we can see, the new model performs better in all cases and sometimes was also able to catch the inverse cases in advance. More on inverse cases and how to identify and use please check here.

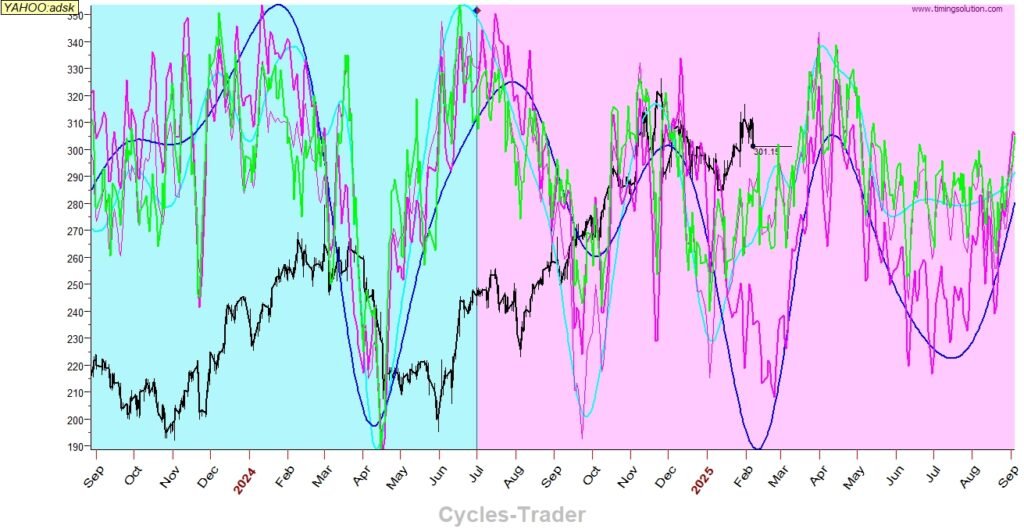

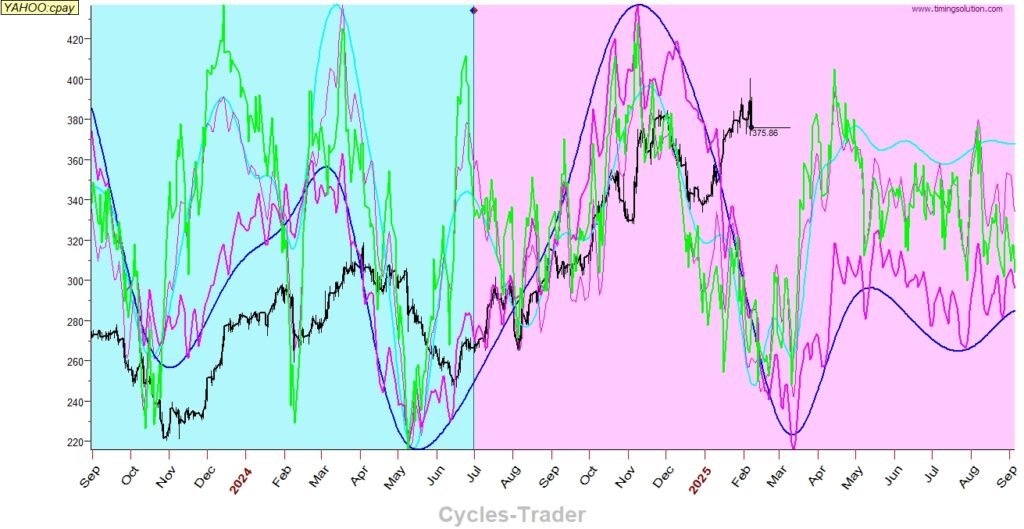

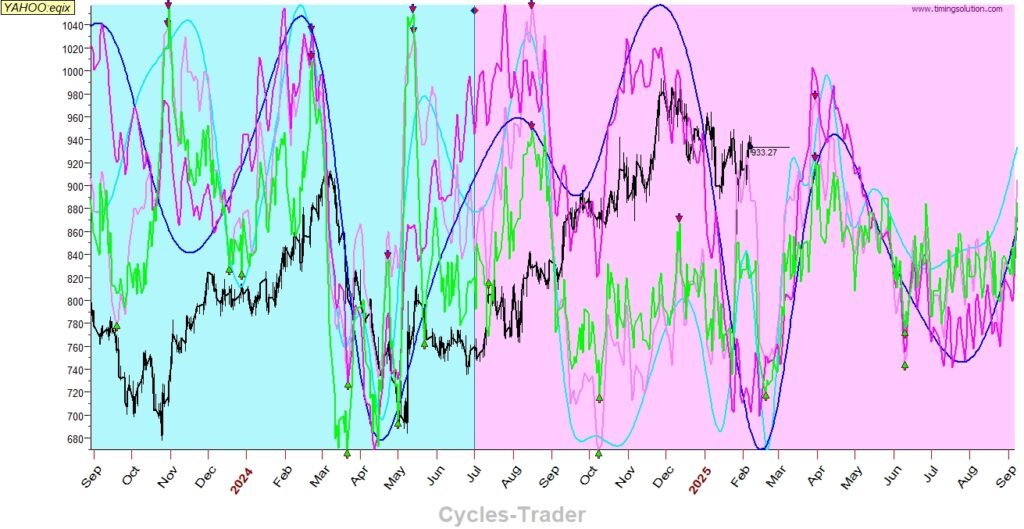

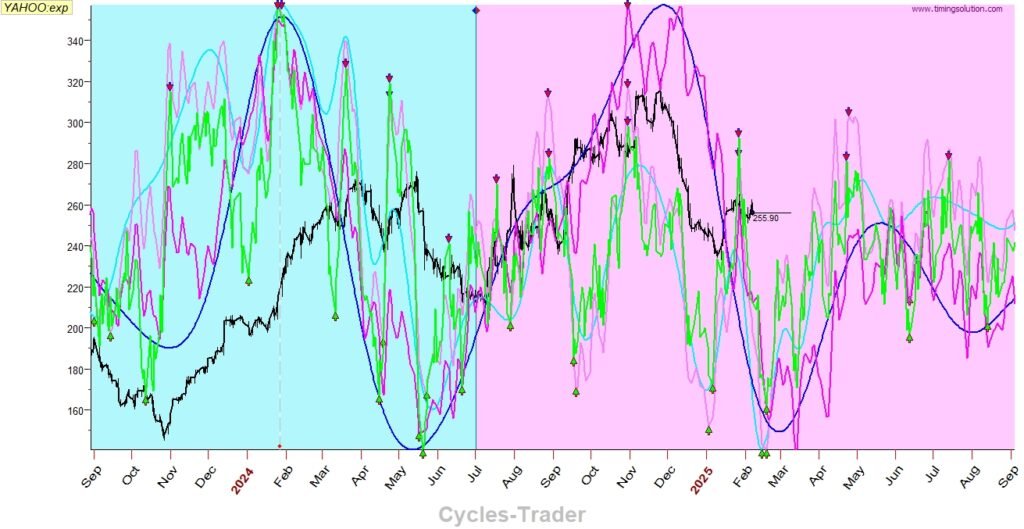

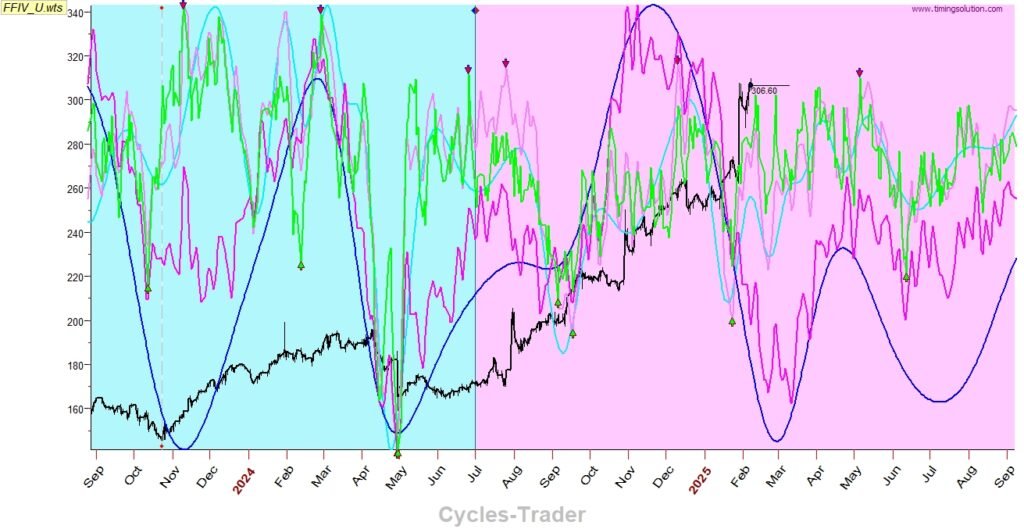

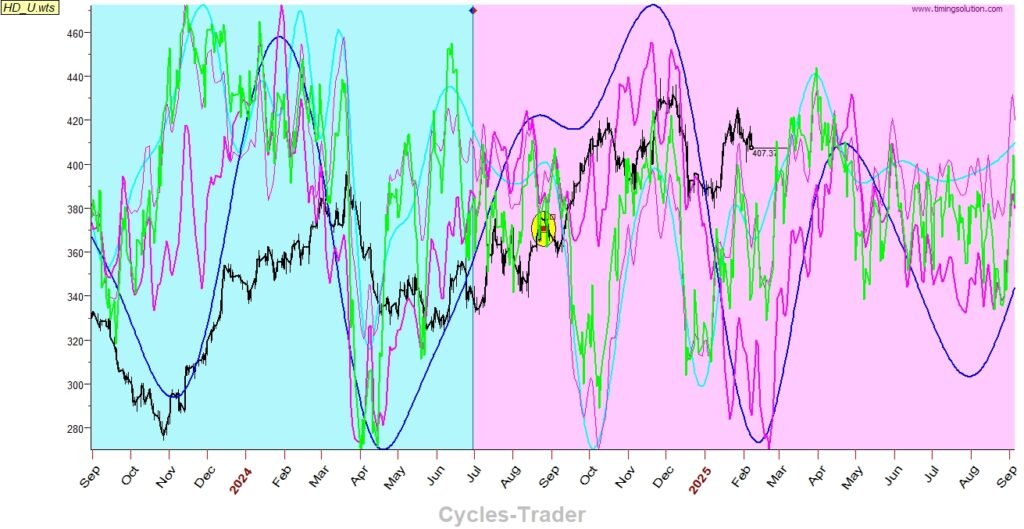

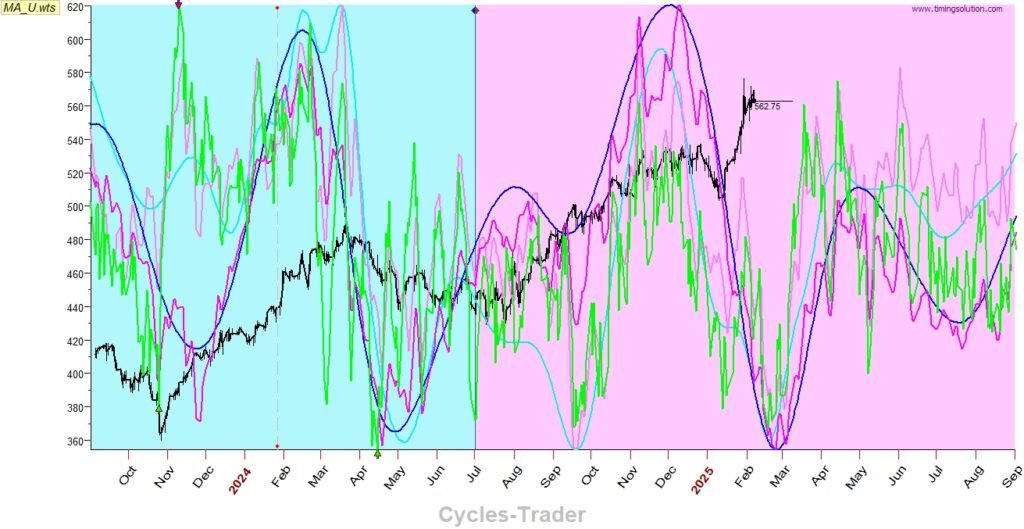

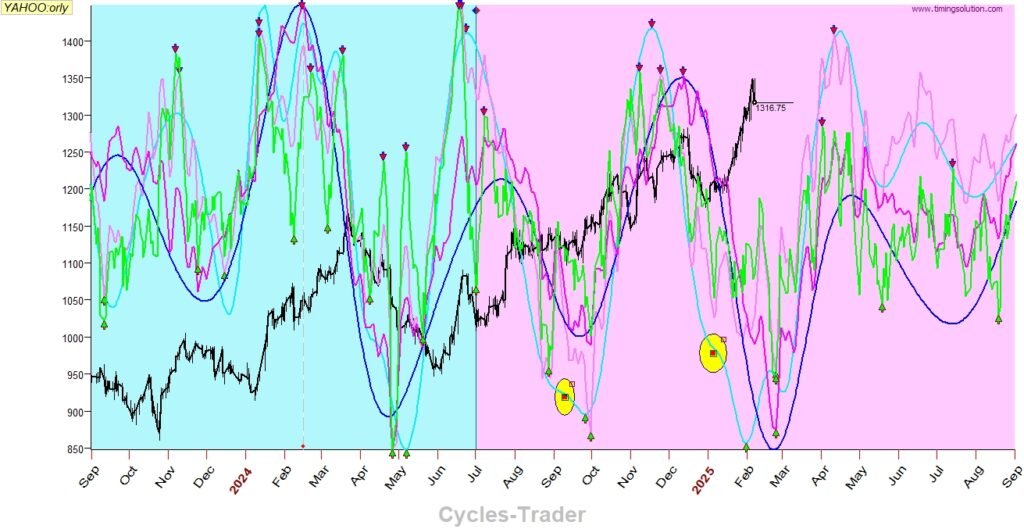

Legend of the charts for the following predictions:

- Dark blue: existing weekly model

- Dark pink: existing daily model

- Light blue: new weekly model U

- Light pink: new daily model U

- Light green: an even newer better version of the new light pink model, model J

Yellow circles indicate potential inverse area.

The verification list of 19 stocks is a mixed bag from different sectors and different price levels and volatility: NEM, LMT, CEG, AZN, AMD, VST, ZETA, ACN, ADSK, CPAY, EQIX, EXP, FFIV, HD, MA, ORLY, PH, TRV, V.

Please note: this is not a trading advice. These prediction algorithms are developed to be more precise in the 6 months period so it is not advised to use these charts for trading after Feb 2025. However, It is recommended to keep tracking the performance of these charts to verify their potential.

NEM

LMT

CEG

AZN

AMD

VST

ZETA

ZETA with the existing model in Inverse mode

ACN

ADSK

CPAY

EQIX

EXP

FFIV

HD

MA

ORLY

PH

TRV

V

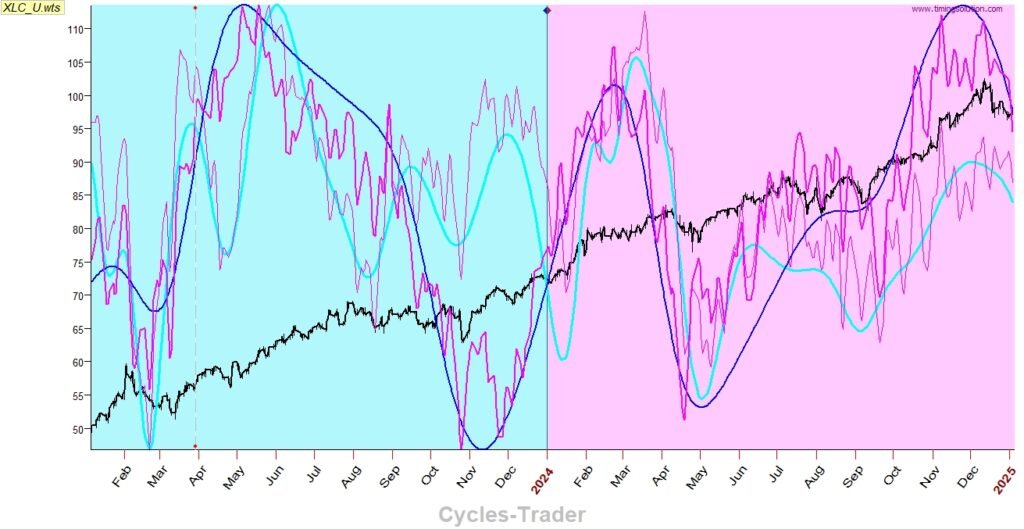

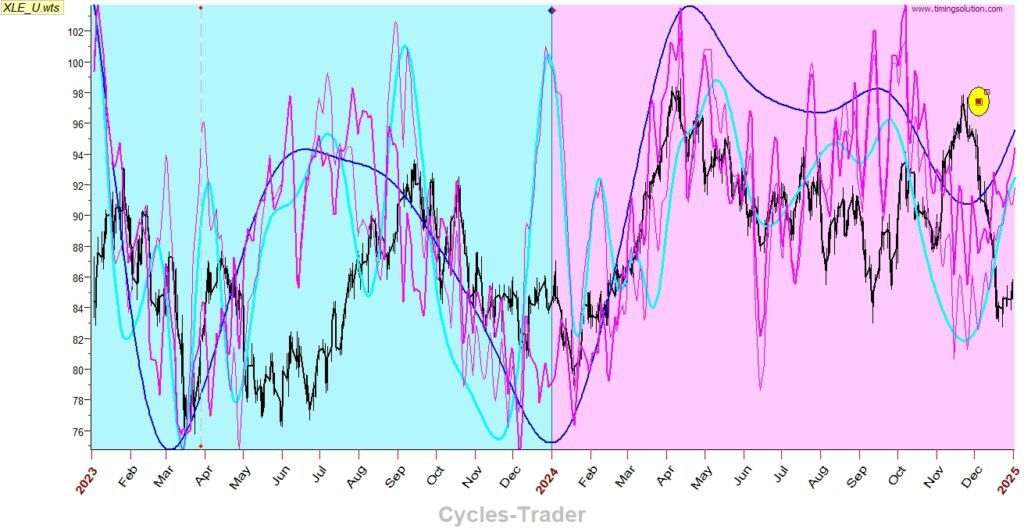

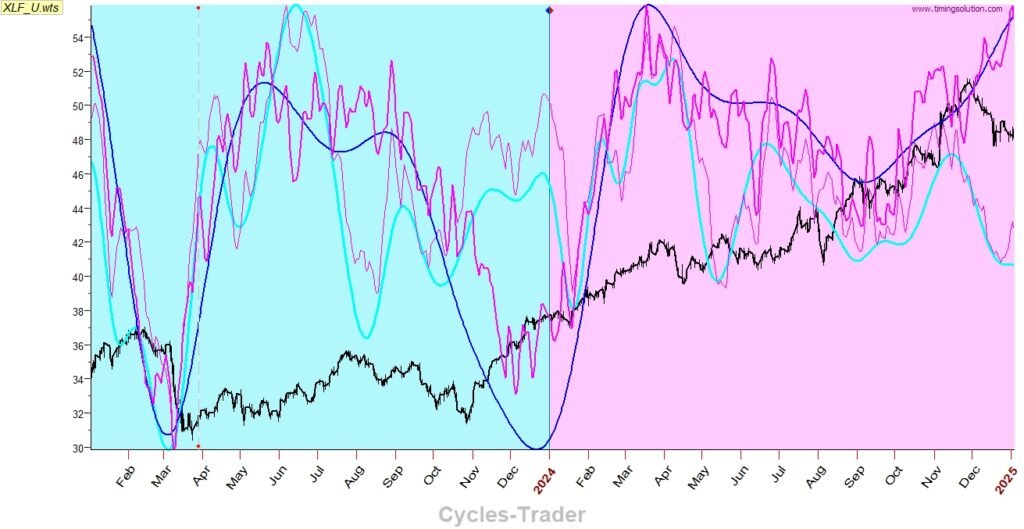

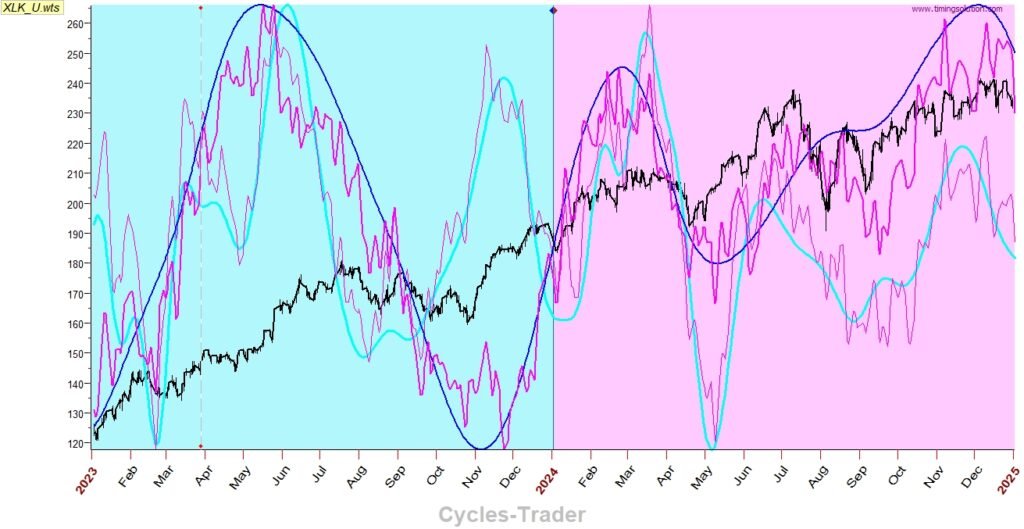

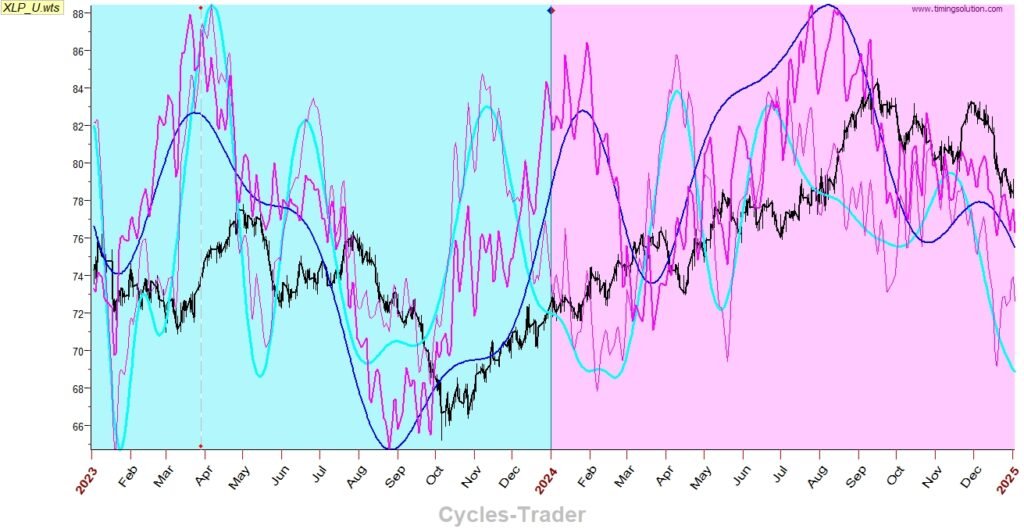

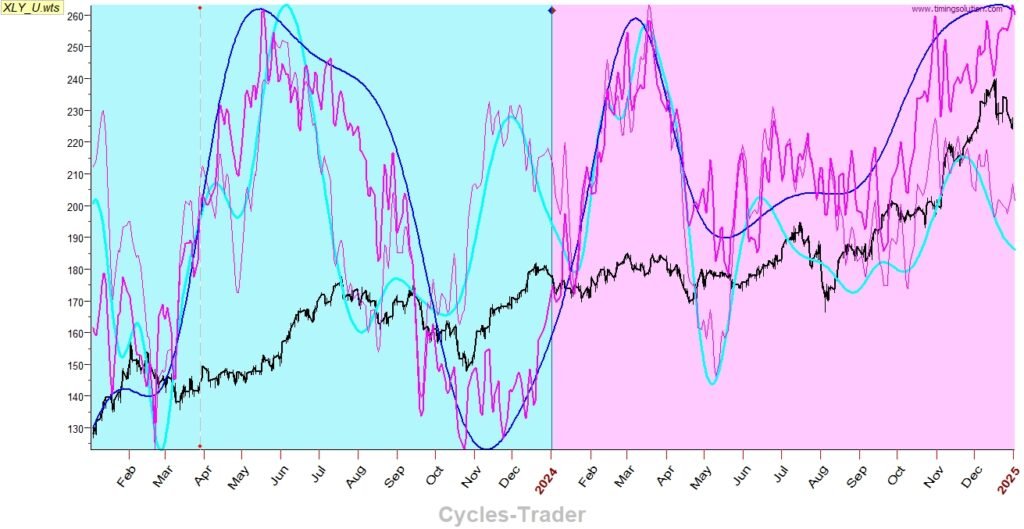

Verification of the new U model with the “XL” sectors

Here we compare the existing model with the new model U on 6 XL price instruments: XLC, XLE, XLF, XLK, XLP, XLY over a period of one year, from Jan 2024 till Jan 2025.

As we can see, sometimes the new model works better than the existing model.

Legend of the charts for the following predictions:

- Dark blue: existing weekly model

- Dark pink: existing daily model

- Light blue: new weekly model U

- Light pink: new daily model U

XLC

XLE

XLF

XLK

XLP

XLY

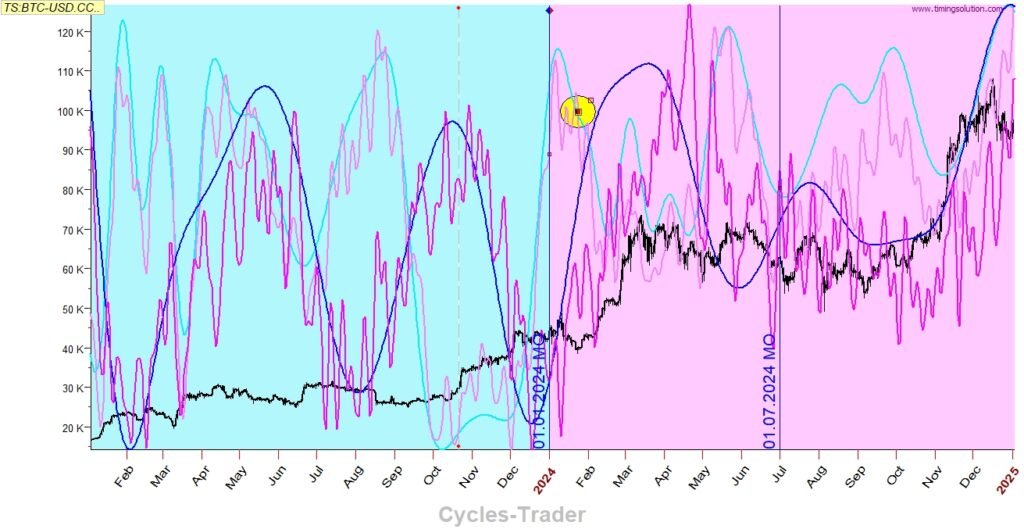

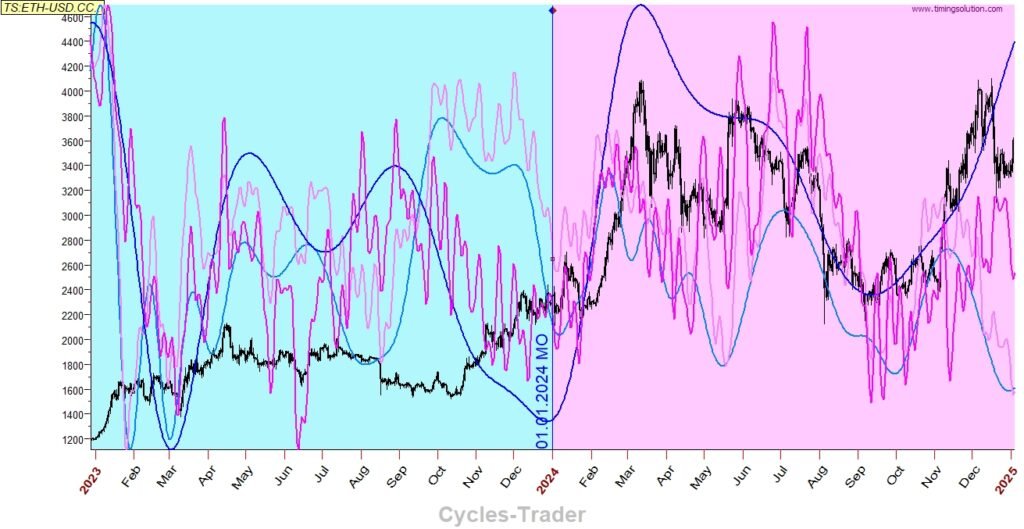

Verification of the new “U” model with Crypto

Bitcoin (Inverse)

Ethereum

Solana (Inverse)