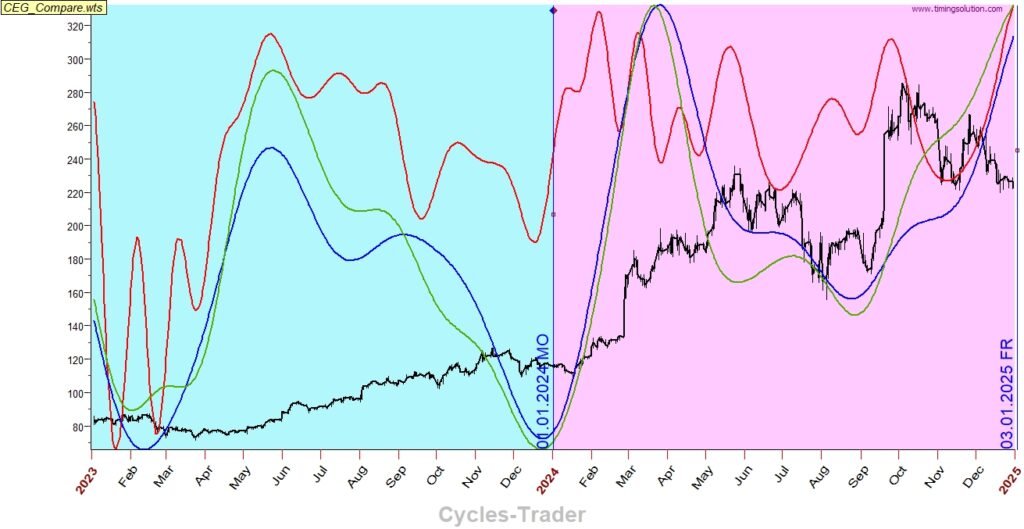

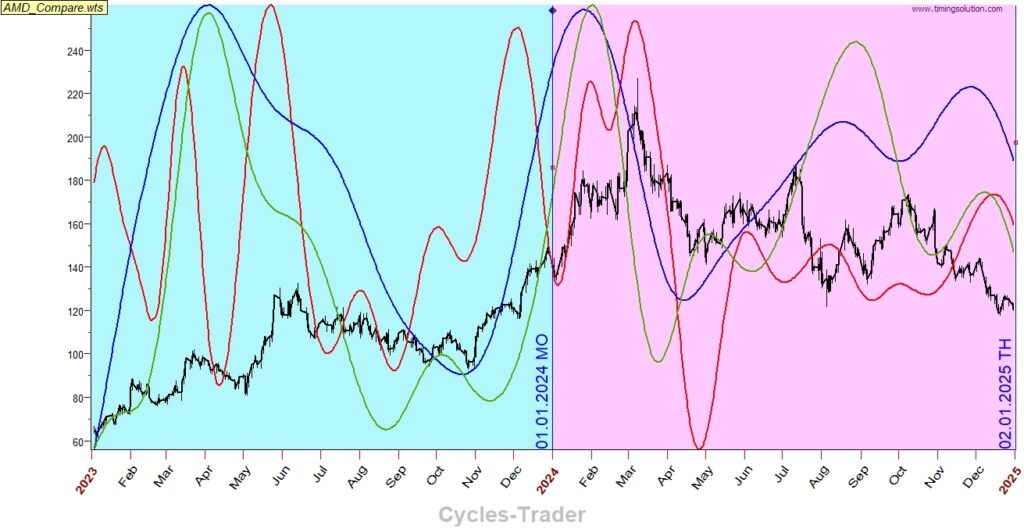

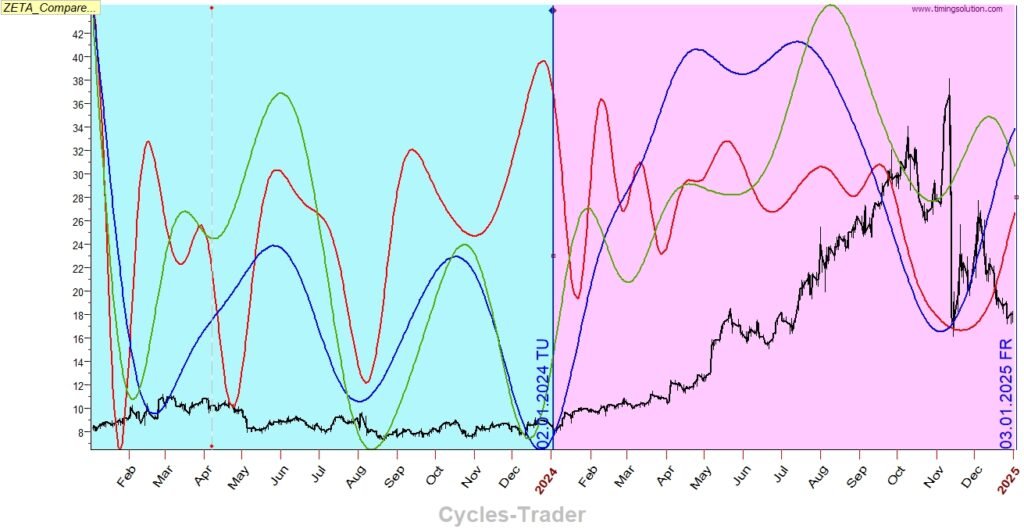

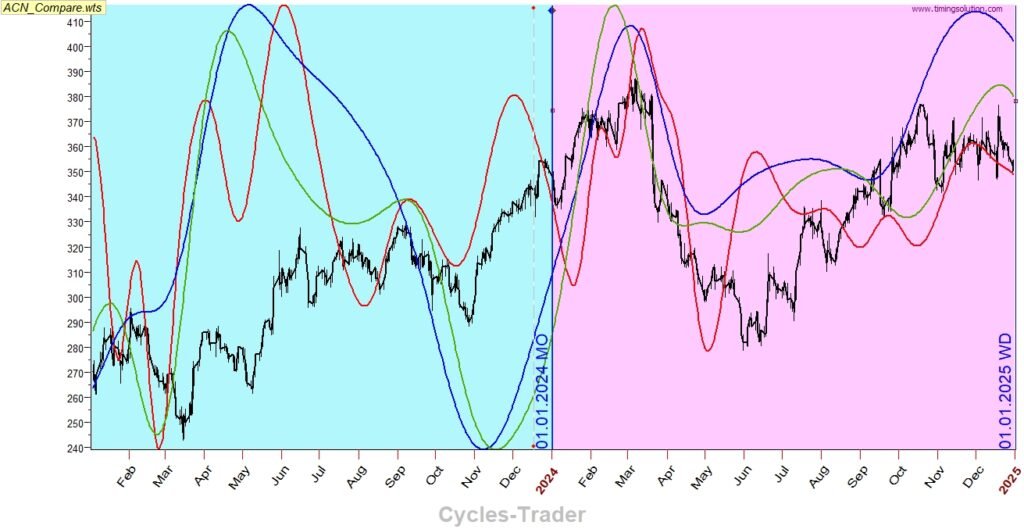

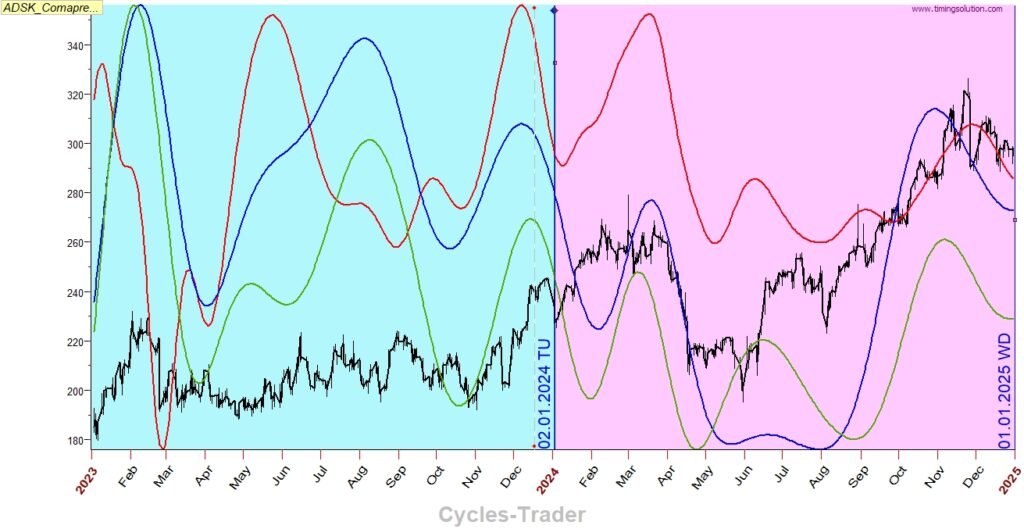

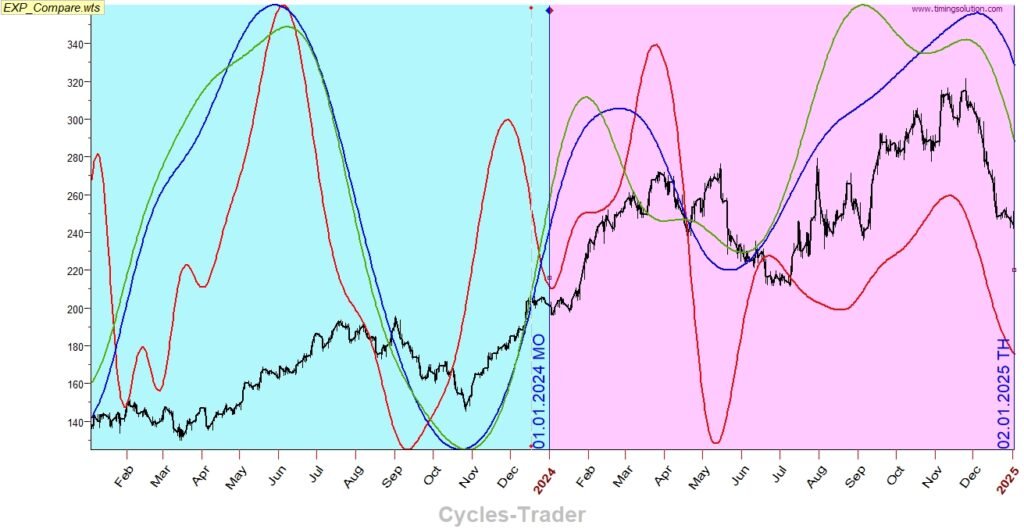

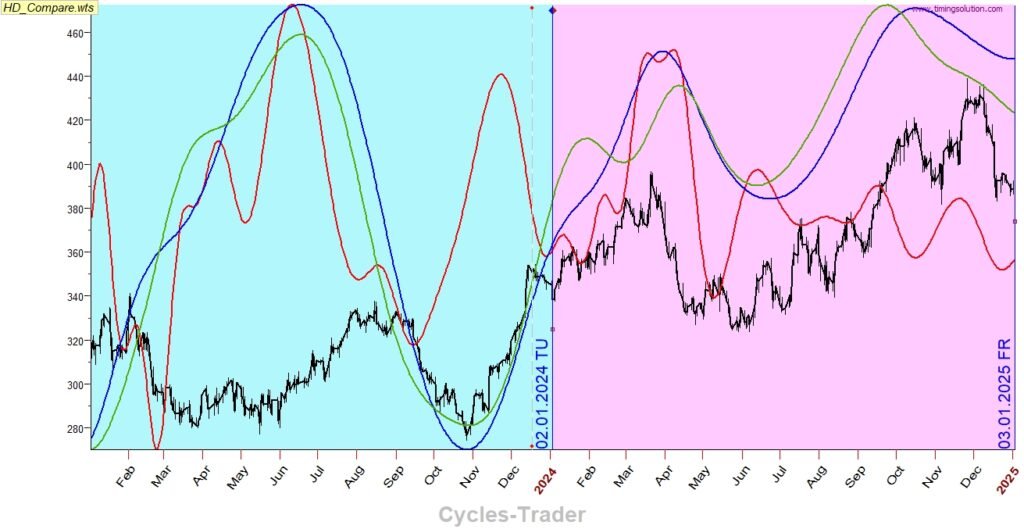

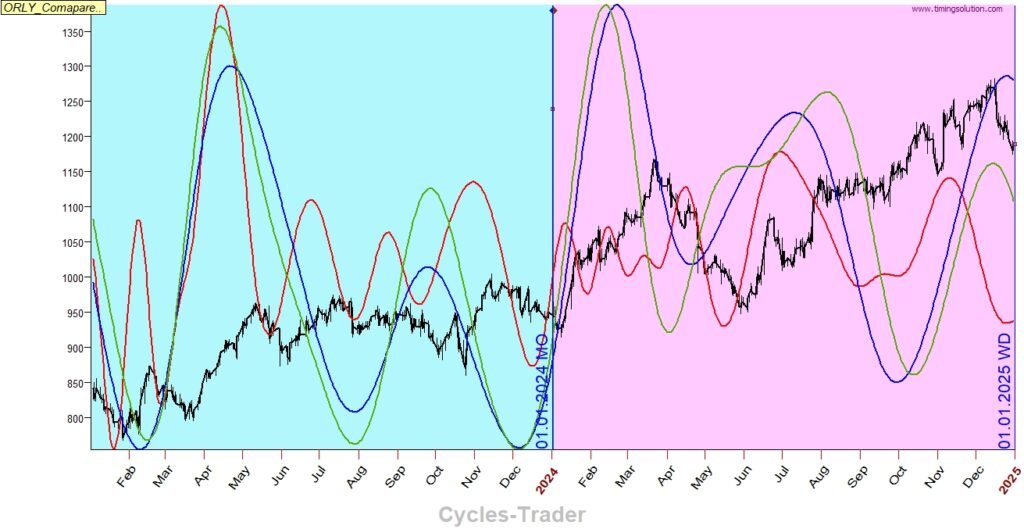

In this post we present a comparison of the existing model “G” vs the new model “U” mentioned in the last post which includes additional cycles, and a new model “120” which is a variation of the model G..

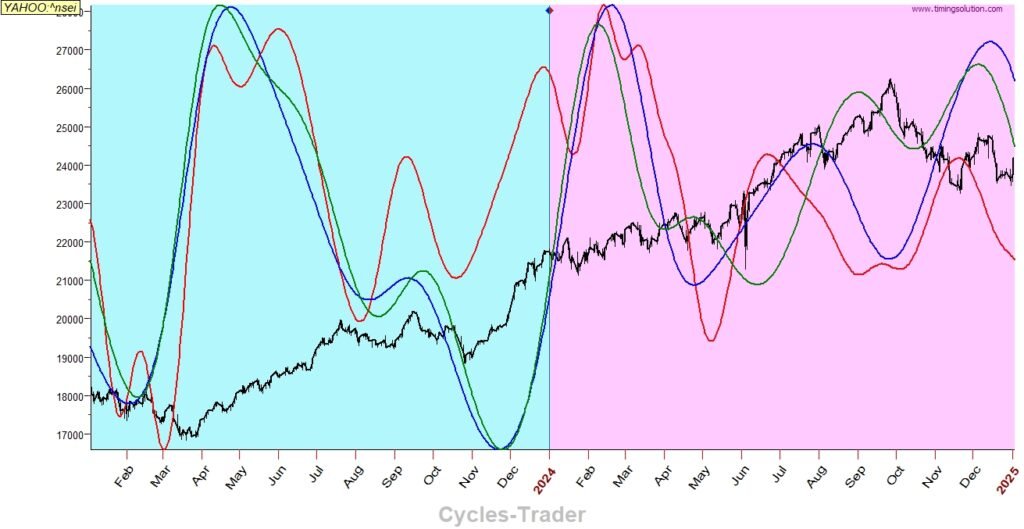

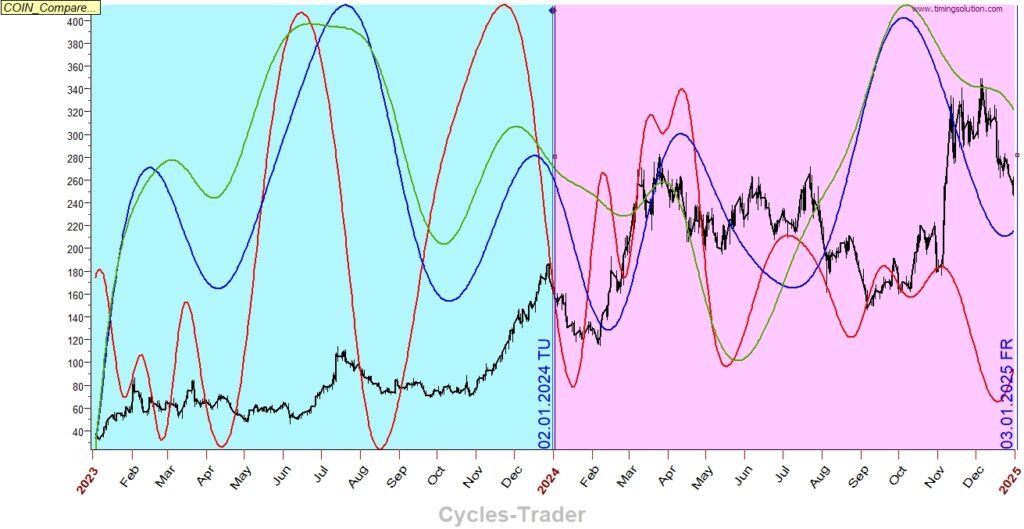

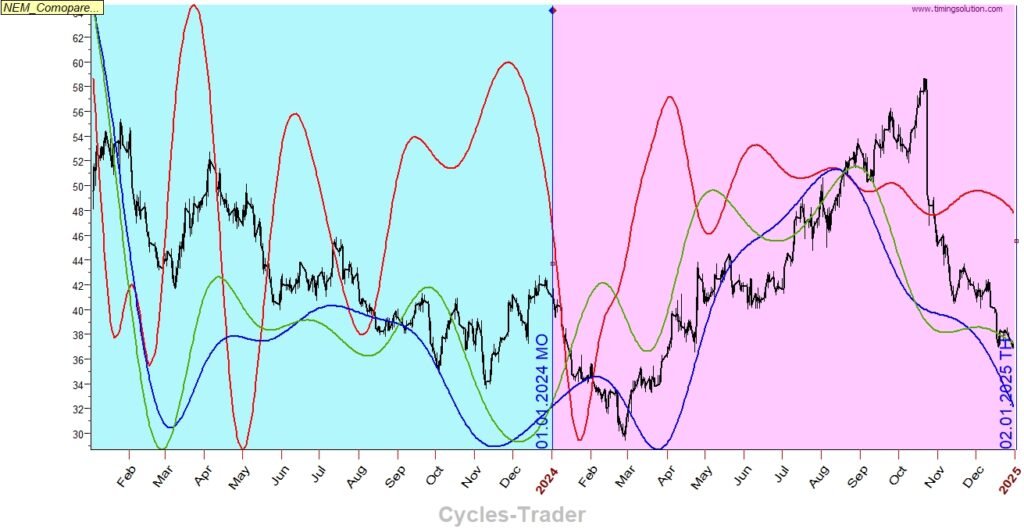

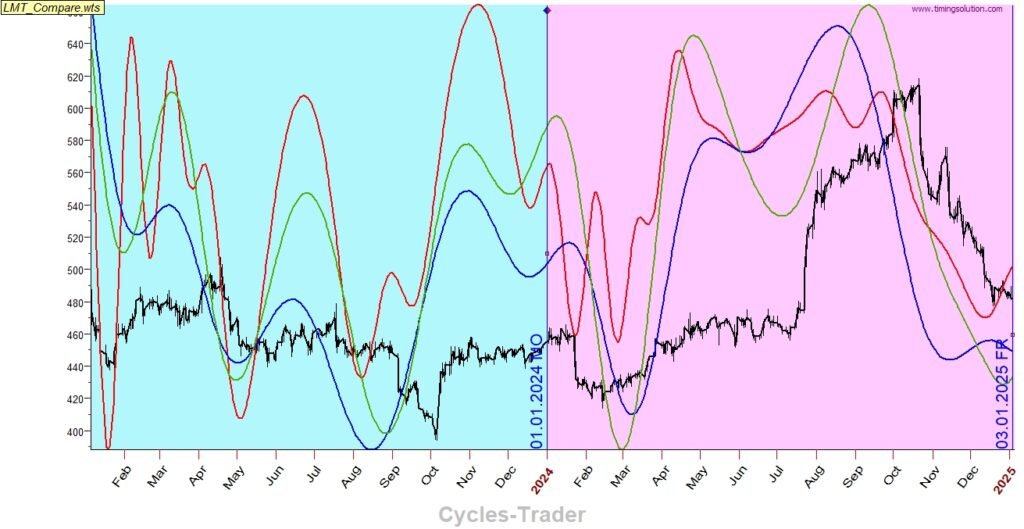

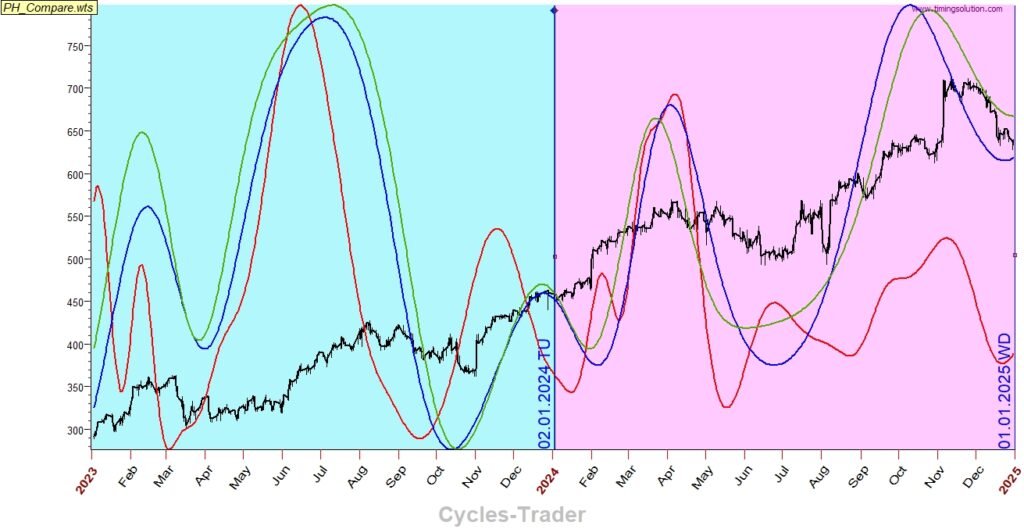

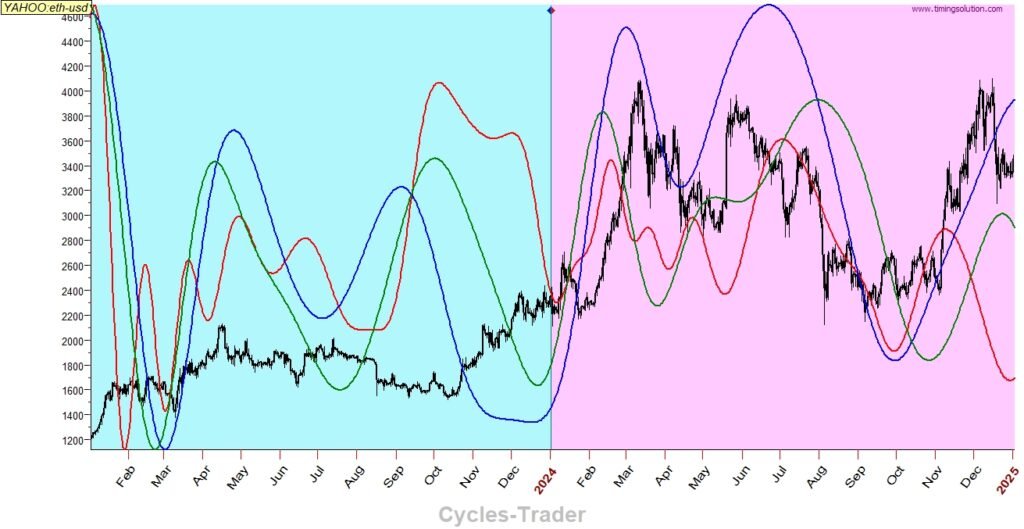

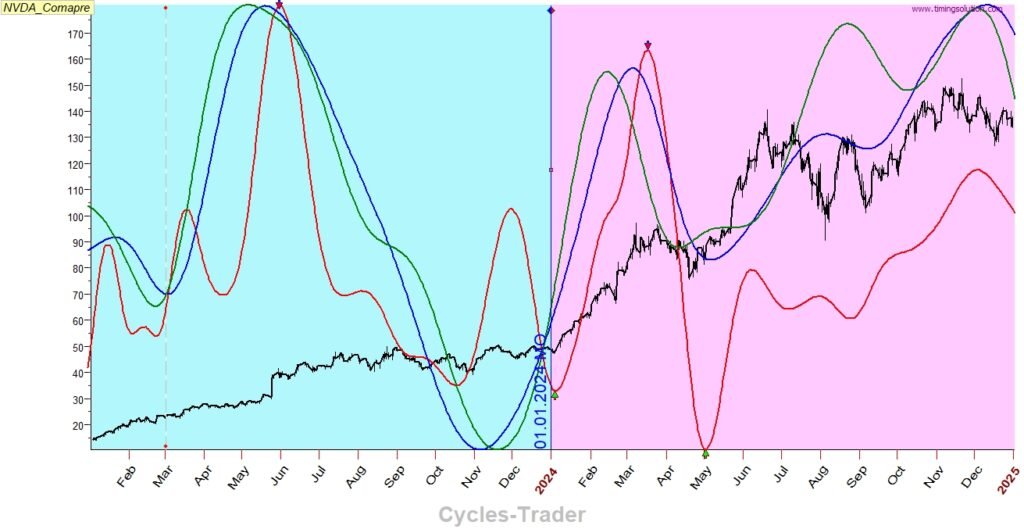

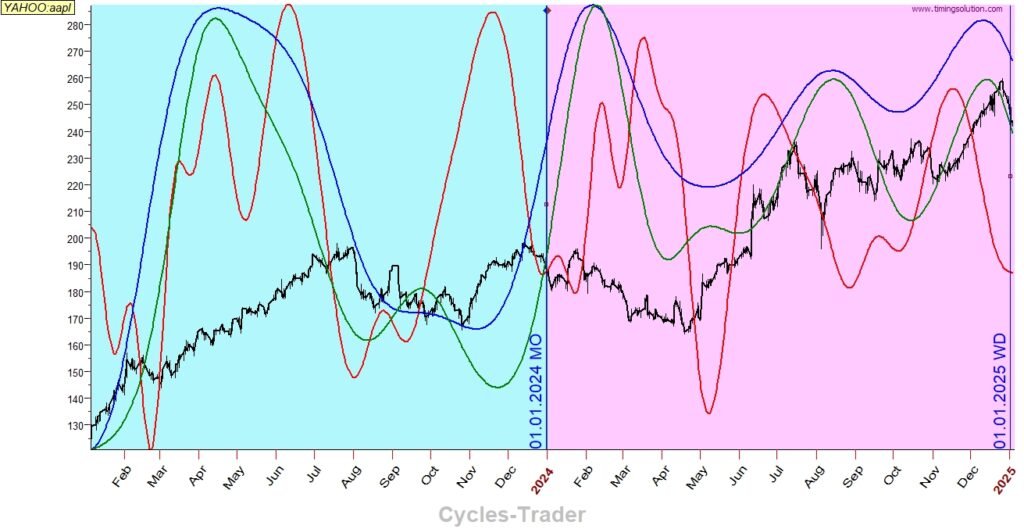

G – Blue line (weekly model) – existing model

120 – Green line (weekly model) – new model

U – Red line (weekly model) – new model

Compared stocks:

There are 27 price instruments compared, from different sectors and different price levels: SPY, COIN, NEM, LMT, ENPH, CEG, AZN, AMD, VST, ZETA, ACN, ADSK, CPAY, EQIX, EXP, FFIV, HD, MA, ORLY, PH, TRV, V, ADBE, ETH-USD, NVDA, AAPL, NIFTY-50.

Comparison period:

The comparison period is one year (from 1-1-2024 to 1-1-2025), which is far beyond what is offered as prediction, for two reasons: to enable a wider scale for comparison, and to show that the models can most accurately predict up to a year ahead.

Conclusions:

- Existing model (G) is performing well for long term predictions.

- Model 120 sometimes adds more information on top of model G.

- New Model (U) may be sometimes more accurate for the short term of few weeks.

Operatives:

The U model will be considered to added to the delivered charts of existing G model.

Since there may be more inverse cases for the U model, the U model inverse chart will also be delivered.

IN the case of adding the model U, Model G provides the general trend while model U provides some more details.

Details:

SPY

COIN

NEM

LMT

ENPH

CEG

AZN

AMD

VST

ZETA

ACN

ADSK

CPAY

EQIX

EXP

FFIV

HD

MA

ORLY

PH

TRV

V

ADBE

ETH-USD

NVDA

AAPL

NIFTY-50